Background

Account based pension certificates; Account based pension projections; Lifetime pension certification; Fixed term pension certificates.

Self managed superannuation funds are an efficient vehicle for families to provide their superannuation benefits. They are restricted to four members, have lower disclosure requirements than larger funds and are regulated by the Australian Tax Office. If they pay lifetime pensions, they are subject to more stringent actuarial standards than larger funds.

Services

The practice’s services in this area are normally provided to accountants, financial planners and trustees of these funds. These services include: –

-

Valuation and certification of adequacy- the practice performs valuations required under Superannuation Industry (Supervision) Regulation 9.31 in compliance with the Institute of Actuaries of Australia’s Professional Standard 400 and Guidance Note 465. Valuations typically determine the funds needed to provide contracted benefits and the likelihood of the funds proving adequate. The likelihood of the funds proving adequate three years hence is also determined on the assumption that no member dies in the intervening period. Pursuant to the Standard, the valuation comments on the suitability and compliance with the investment policy of the Fund. Valuations are required annually and are undertaken for both compliance and prudential reasons.

-

Apportionment of income between pension and non pension assets- income from assets required to support the payment of pensions of any sort is tax exempt. Unless the assets of the Fund are “segregated”. Tax law requires annual actuarial certification of the proportion of income attributable to the pension assets. Income from assets comprising reserves is not tax exempt and needs to be separately identified.

-

Certificates for Social Security purposes- the practice can provide certificates required for Social Security purposes in connection with complying pensions. The first of these certificates determines the capital value of pensions on commencement using the Australian Government Actuary’s calculation basis of an eight year age rating down, the ten year bond rate and if necessary capital CPI indexed bond yields. The second certificate is an annual certificate of sufficiency. The taxation certificate can be used for this purpose.

-

Certificates for segregation of assets- certificates segregating assets required to meet pensions in the course of payment are necessary if trustees wish to “segregate” their fund. These certificates can be prepared at the commencement of a pension or at the end of a financial year. In the case of lifetime pensions, segregated assets change from year to year as reserves are progressively committed to pensions if no member dies and annual segregation certificates are included in the valuation certificates.

-

Certificates for Australian Accounting Standard AAS25- as part of the reporting on the valuations of fixed term and lifetime pensions, the certificates required under Australian Accounting Standard AAS25 are produced.

-

Projections of account based pensions- the practice can produce projections of the assets and payments of account based pensions on the assumptions of maximum, minimum and mid point drawings of pensions.

-

General consulting- most of the practice’s general consulting in this field draws together all of the above processes to assist trustees and their advisers to understand and manage their funds to optimise their value to the beneficiaries.

Benefits

The primary benefit of actuarial advice in this area is the proof of compliance, which allows access to taxation benefits. Actuarial advice in connection with lifetime pensions can be used to maximise a family’s after tax income and wealth. Supplementary benefits of actuarial advice to trustees are those which come from a deeper knowledge of their funds. Trustees’ advisers can benefit from the same knowledge of funds in general. They can harness this knowledge to increase the value of their advice to other clients.

Experience

The practice has been significantly involved in self managed superannuation funds since its 1980 inception. It has worked for numerous accounting and financial planning practices in helping those of their clients who have this type of fund.

Methodology

Generally, the practice’s methodology involves the use of factors that give the same effect as individual cash flow projections and the discounting of those cash flows. In the case of lifetime pensions, probabilities of death are incorporated in the calculations. These are not needed in other cases As in all fields, the practice gives due regard to the likely range of results as well as the central estimate of the result. This is mandatory in the case of lifetime pensions. The practice does this by performing multiple simulations of the funds.

Client assisted certificates

The practice has developed a workbook(.xlsm), which can be used by accountants and fund administrators to provide the necessary information for a tax certificate and simultaneously calculate the tax free proportion and, if required, members’ final balances. Clients can populate the workbook and send it to the practice for final checks and certification. While not valid until signed, the workbook provides information to allow clients to continue preparing the accounts and returns of funds in anticipation of the final signed certificate. For the workbook to operate users need to have macro settings at low or medium security. An example input sheet is available(.xlsm) which is populated with typical data. Other resources available for you to download are an example report(.xlsm) , a flow chart(.pdf) showing the process for the accountant and actuary and an adjusted reprint of the flyer(.pdf) initially announcing the client assisted certificates process.

Information needs

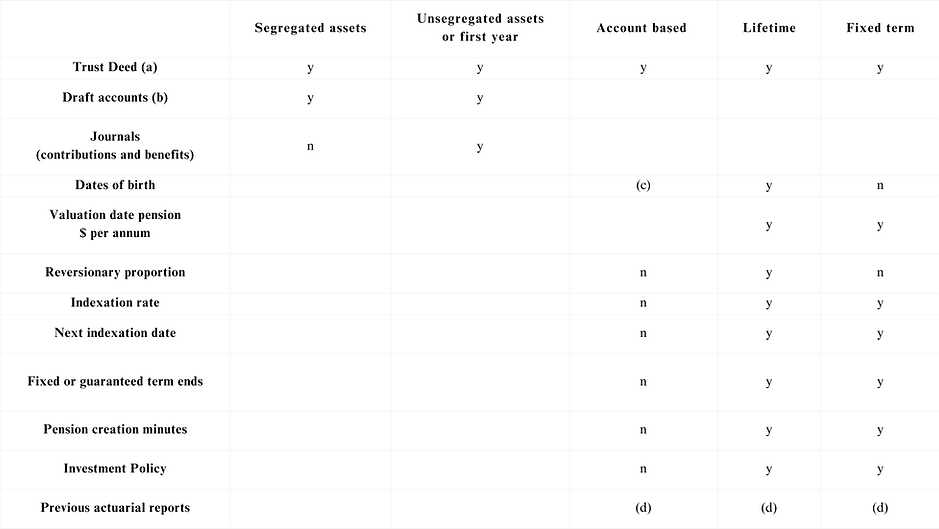

The information that the practice usually needs to do any work for self managed superannuation funds depends on the segregation or otherwise of the fund’s assets and the nature of the pensions provided. It includes:

(a) In the case of second or subsequent assignments, a statement to the effect that there has been no change in the trust deed is sufficient.

(b) Year end or commencement of pension.

(c) Only required if certificate of maximum and minimum pension is needed.

(d) Last certificate and (for first review) reports dealing with the creation of pensions.

1.png)

Timing

Certificates are normally produced within five business days of receipt of all information. Urgent tasks will be completed within two business days and attract a 15% surcharge.

FAQ’s

If your question is not dealt with below please refer to our FAQ page.

Q1: High probability not applicable – Still sufficient – Tax consequences…What are the tax consequences of the actuary not being able to certify a high probability of sufficiency but still being able to certify sufficiency?

There are none, as long as the fund is sufficient to meet its liabilities, the fund is solvent and the ATO has no issues with it.

Q2: High probability not applicable – Still sufficient – Social Security consequences…What are the Social Security consequences of the actuary not being able to certify a high probability of sufficiency but still being able to certify sufficiency?

Action to ensure a high probability is necessary. This normally takes the form of a reduction in pension. This is normally achieved by commutation of the initial pension and establishment of a new pension. This process has consequences under the deprivation provisions of the legislation. The difference between the “high probability” cost of the pension and its Social Security valuation is deemed to have been a gift for these provisions.

Q3: High probability of sufficiency at pension start – Who needs it…Is it necessary to have a high probability of sufficiency at the start of a pension?

Only if the pensioner is relying on the pension for Social Security assets test exemption purposes. If there is no Social Security consideration, the law merely requires actuarial opinion as to whether there is a high probability of sufficiency not a high probability per se. Many pensioners prefer to have a high probability to enhance the security of their pension, reduce the risk of needing to adjust their pension if the fund becomes insufficient or to minimise their taxable income, but they do not have to.

Q4: Insufficiency – Social Security consequences…What are the Social Security consequences of the actuary not being able to certify sufficiency of a fund?

Action to ensure a high probability is necessary. This normally takes the form of a reduction in pension. This is normally achieved by commutation of the initial pension and establishment of a new pension. This process has consequences under the deprivation provisions of the legislation. The difference between the “high probability” cost of the pension and its Social Security valuation is deemed to have been a gift for these provisions.

Q5: Insufficiency – Tax consequences…What are the tax consequences of the actuary not being able to certify sufficiency of a fund?

Action to restore sufficiency is necessary. The actuary is obliged to issue a Section 130 notice querying the trustee as to how it plans to restore sufficiency and to report failures to restore sufficiency to the ATO. Sufficiency may be restored by either suspension of indexation or a reduction in pension. A pension reduction is normally effected by commutation of the initial pension and establishment of a new pension.

Q6: Do you provide financial advice to self managed superannuation funds?

No, we do not provide any advice to SMSFs. We refer all clients who require financial advice to our associated company Andep Investment Consultancy.

Fees

Fees quoted include GST.

The practice believes that quality service justifies its price, but seeks to be competitive in its fee structure and will quote fixed or maximum prices if required. Hourly fees apply unless the task is solely related to the production of a standard certificate. Where the task makes substantial use of standard systems, usage charges apply.

Title | Rate | Unit |

|---|---|---|

Account based pension projection certificate | $165 inc GST | Person |

Account based pension fund certificate | $660 inc GST | Item |

Client assisted account based pension certificates with calculation of final balances | $480 inc GST | Item |

Client assisted account based pension certificates without calculation of final balances | $400 inc GST | Item |

Fixed term pension valuation certificate | $825 inc GST | Item |

Lifetime pension valuation certificate | $1237.50 inc GST | Item |

Pension fund apportionment certificate | $330 inc GST | Item |