Family and Estates

Valuation of interests in superannuation funds; Valuation of life tenancies and reversionary interests.

Background

Families need to determine values of assets held by family members for either family law or estate wind up purposes. Valuations can also be required in connection with Binding Financial Agreements under the Family Law Act

Benefits

Valuations of superannuation benefits allows parties to comply with the Family Law Act and its regulations.

The primary benefit of actuarial advice concerning life and remainder interests is the provision of independent valuations of interests. This comforts both parties that an estate has been fairly apportioned and protects the executor from subsequent claims.

Supplementary benefits of actuarial advice are those which come from a deeper knowledge of the assets or interests concerned.

Services

- The practice’s services in this area are normally provided to accountants, lawyers or family members directly. These services include: –

Valuation and certification of superannuation interests- the practice performs valuations required under the Family Law (Superannuation) Regulations in accordance with those regulations. These interests may be in accumulation funds, defined benefit funds or in ongoing pensions. - Valuation and Certification of Annuities- the practice performs valuations of entitlements to lifetime incomes provided by either insurance companies or estates. In doing this, it makes allowance for the probabilities of death allowing for continued improvement in mortality rates and for the growth characteristics of the life time income.

- Valuation and Certification of Life Tenancies- the practice performs valuations of the entitlement of one or more persons to occupy a property or to the income of an estate during their life times. In doing this, it makes allowance for the probabilities of death allowing for continued improvement in mortality rates and for the income and growth characteristics of the estate or property.

- Valuation and Certification of Remainder Interests- the practice performs valuations of the entitlement to possession of a property or estate on the death of one or more persons who have the right to occupancy or income during their life times. In doing this, it makes allowance for the probabilities of death allowing for continued improvement in mortality rates and for the income and growth characteristics of the estate or property.

The sum of the values of life interest and remainder interests in a particular property or estate is the unencumbered value of the property or estate.

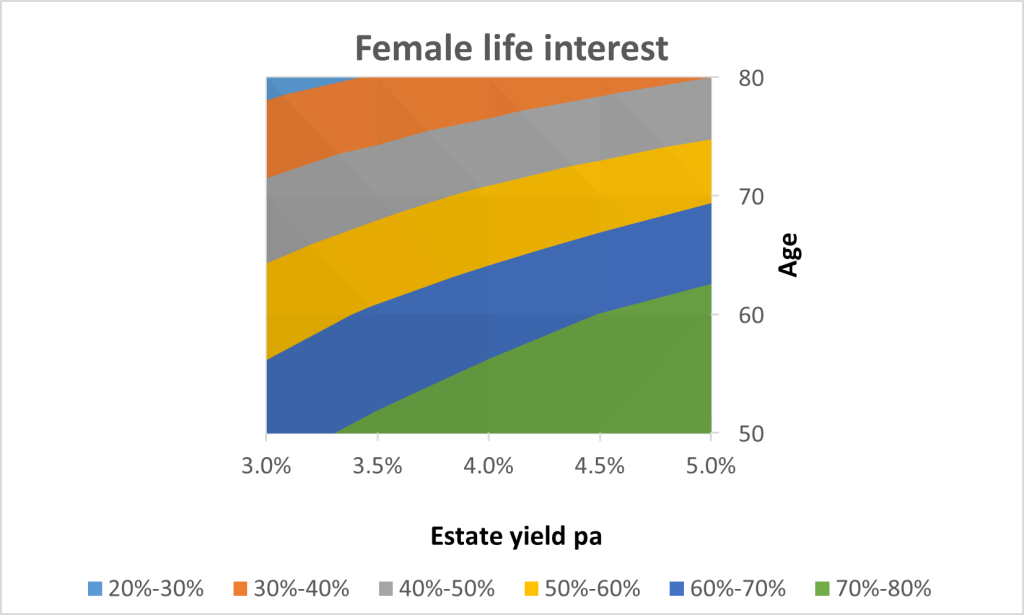

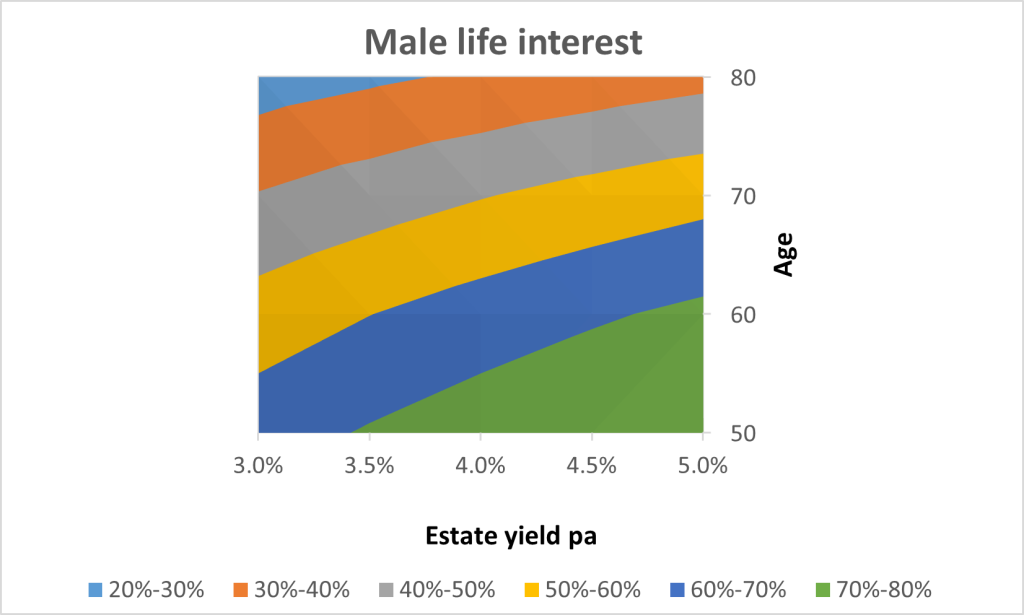

The following tables and charts show, at July 2024, the proportion of an estate’s value attached to life and remainder interests for various ages and estate net earning rates. The practice will calculate exact values of interests for exact ages and earning rates in individual cases on request. The values change as mortality rates improve.

| Female life interest factors as at 01 Jul 2024 | Male life interest factors as at 01 Jul 2024 | ||||||||||||

| Estate earning rate pa | Estate earning rate pa | ||||||||||||

| Age | 3.0% | 3.5% | 4.0% | 4.5% | 5.0% | Age | 3.0% | 3.5% | 4.0% | 4.5% | 5.0% | ||

| 50 | 67% | 72% | 77% | 81% | 84% | 50 | 66% | 71% | 75% | 79% | 83% | ||

| 60 | 56% | 61% | 66% | 70% | 74% | 60 | 54% | 60% | 65% | 69% | 72% | ||

| 70 | 42% | 47% | 51% | 55% | 59% | 70 | 40% | 45% | 49% | 53% | 57% | ||

| 80 | 27% | 30% | 34% | 37% | 40% | 80 | 25% | 28% | 31% | 34% | 37% | ||

- General Consulting- the practice can assist families or their advisers in the determination of arrangements involving payments contingent on life or death of individual family members.

Methodology

In the valuation of superannuation interests, the practice uses the methodology laid down in the Family Law (Superannuation) Regulations.

In the valuation of other interests, the practice’s methodology involves the use of factors that give the same effect as individual cash flow projections and the discounting of those cash flows. Probabilities of death and allowance for growth in income and capital values are incorporated in the calculations.

As in all fields, the practice gives due regard to the likely range of results as well as the central estimate of the result.

Experience

The practice has been continually involved in the valuation of superannuation, life and remainder interests since its 1980 inception. It has worked for numerous solicitors and barristers in helping their clients with these issues. It is the practice’s experience that most cases do not go to trial and that, for those that do, actuarial evidence is rarely challenged. Nevertheless, some cases do go to trial and the practice has experience of giving expert evidence in these matters.

Information Needs

The information that the practice needs to value superannuation interests is generally that which can be obtained from the superannuation fund trustee under Division 7.2 of the Family Law (Superannuation) Regulations. This can be supplemented by the information contained on the superannuation fund member’s statements for the previous two years.

For valuation of other interests, the following information is generally needed: –

- Copy of the document creating the interests;

- Copy of the last annual accounts of the subject estate;

- Up to date statement of the assets of the estate;

- In the case of life tenancies of property, a real estate valuer’s opinion of –

- the value of the property and

- the net rental that it could command and

- For every person whose death influences the value of the estate –

- date of birth,

- sex and

- either

- a statement to the effect that they are in normal health for one of their years,

- an instruction to assume that they will suffer mortality rates applicable to a person n years above their true age or

- an instruction to assume that they will suffer mortality rates p% higher than those appropriate to their age (akin to an insurance loading).

Fees

The practice believes that quality service justifies its price, but seeks to be competitive in its fee structure and will quote fixed or maximum prices if required.

Hourly fees apply unless the task is solely related to the production of a standard certificate. Where the task makes substantial use of standard systems, usage charges apply.

Fees quoted do not include GST.

Description |

Rate |

Unit |

| Life and remainder interests | ||

| Apportionment of an estate into life and remainder interests – calculation fee | $187.50 | Item |

| Apportionment of an estate into life and remainder interests – estate value fee | $0.50 | $’000 |

| Apportionment of an estate into life and remainder interests – matter fee | $187.50 | Item |

| Superannuation family law | ||

| Family Law (Superannuation) Certificate Fee | $818.18 | Item |